An Overview Of Market: Gold Prices on the Decline

As markets process the Federal Reserve’s cautious approach to interest rate cuts and uncertainty surrounding President-elect Donald Trump’s upcoming policies, gold prices saw a significant decline today, January 13, 2025, in both international and Pakistani markets, driven mainly by strong U.S employment data and a strengthening dollar.

Changes In Global Markets: Pressure on Gold Prices

The price of gold dropped $15 per ounce on the worldwide bullion market, ending at $2,675. During early trading hours (09211 GMT), spot gold fell 0.1% to $2,686.33 an announce, revising its one- month highs set last Friday. Additionally poor were U.S gold features, which fell 0.2% tp $2,710.60

Pakistani Market Update: Local Gold Prices Decline

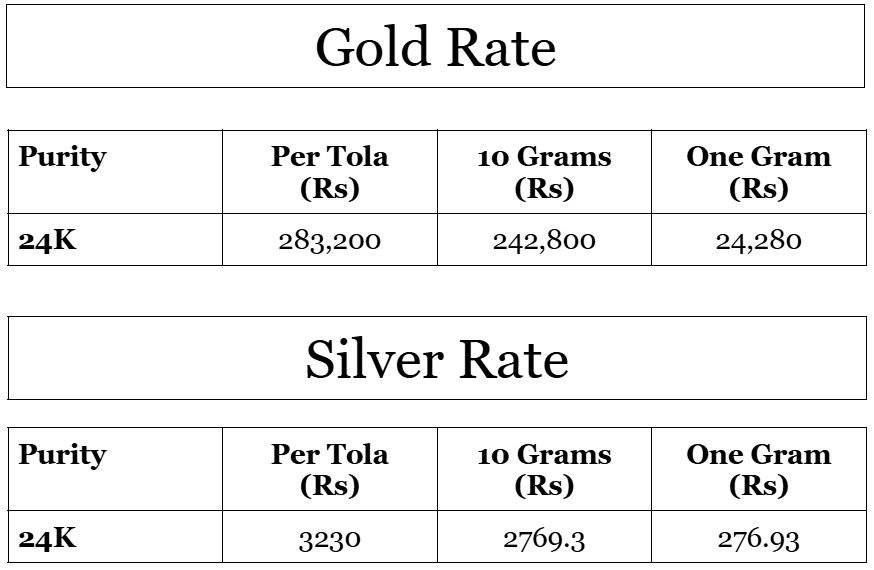

The decline in gold prices was similarly noticeable in Pakistan’s local markets:

- The price of 24-carat gold per tola dropped by Rs 1,500 to Rs 279,300.

- The price of gold dropped by Rs 1,286 per 10 grammes, reaching Rs 239,455.

- The price of silver stayed steady at Rs 3,350 per tola.

- The price of 10 grammes of silver remained at Rs 2,872.08.

Factors Contributing to the Decline in Gold Prices

The recent decline in gold prices can be attributed to several key factors:

Strong Dollar Performance

After the U.S jobs report was released, the dollar index hit a peak that had not been seen in more than two years. Since gold is predominately valued in U.S dollars, this currency strengthening has increased the price of the precious metal for buyers from other countries.

Federal Reserve’s Stance

The Federal Reserve’s cautious approach to monetary policy easing third year has been strengthened by recent economic data. The Fed may continue to take a cautious approach to interest rata decreases, which usually puts pressure on gold prices, according to the goof employment data.

Political and Economic Uncertainty

Gold continues to find support from a number of sources despite the price decline:

- Concerns about inflation persist in major economies

- Trump’s impending presidency is uncertain

- Possible introduction of additional import taxes

- Increased energy costs impacting international markets

Expert Analysis on Gold Prices

Giovanni Staunovo, an analyst at UBS, states:

“Stronger dollar and higher U.S. rates remain a headwind for gold, but at the same time elevated market uncertainty coming from higher energy prices, potential tariffs and ongoing inflation concerns, supports safe-haven demand for the yellow metal.”

Looking Ahead at Gold Prices

The Situation is being closely deeply watched by economies as Trump’s inauguration is set for January 20. His proposed tariffs may lead to trade wars and raise inflation, according to some experts. Gold prices, which are typically thought of as a hedge against inflation and economic and uncertainty, may see higher demand and better performance in such a situation.

Global economic uncertainties and possible inflationary pressures, along with the downward pressure from a strong dollar, continue to support the market.